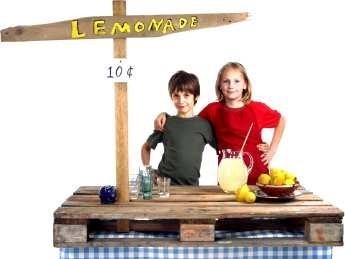

Everyone reading this article has passed dozens of lemonade stands in their lifetimes, especially on those hot lazy, hazy summer days. This article was crafted to see if there are subtle, yet classic lessons that we can all learn from thinking seriously about those tiny, innocent lemonade stands.

The first lesson could also be the cliche, "There is a silver lining in every cloud." What this means is that an opportunity may exist even in the midst of the storm. In the real estate industry, we are all reading and hearing about the "bust" that has engulfed the real estate market. And in some ways, we all saw this coming, as we also read articles and listened to new casts that spoke of the risks of the prior real estate "boom." With most of the current news being negative, now is in fact the time to remember the key mantra of making money with any asset — buy low and sell

The second lesson is another cliche—timing is everything. We all see the price of holiday decorations just a few weeks after the holidays — there is a steep discount, due to timing. Since the R/E market is just that, a market, it has a pattern. There are ups and downs in that market. While no one can predict the timing of the ups and downs, it is rational to assume that the pattern of ups and downs will continue into the future. These patterns are driven by hard facts (supply and demand) and market psychology (customer sentiment). While in the long-run, hard facts win the day, in the short-run, market psychology is extremely powerful. For example, undisciplined investors poured money into new condos under construction in Miami and Las Vegas, sight unseen in some cases, as they were simply flipping these purchases for easy money ... it was like a party. Now the music at the party has stopped, the investors have stopped pouring in speculative money, and prices are dumped like a rock. So while we don't know how low the market will fall and we do not know when the market will start to trend back up, we do know that this is

The third lesson is another cliche— risk little, win little. Yes, that little kid on the corner could lose money buying the lemons and mixing the drinks, yet it is guaranteed that the same child would not make any money if he/she didn't make an attempt. It is said that the harder you work, the luckier you become. It is also said that you have to be in the mindset to hear the knock of opportunity. It is believed that so few people hear opportunity knocking is that it is often camouflaged behind some hard work. For investing, hard work is reading a diverse mix of real estate journals that give specifics and generic business journals (i.e., Wall Street Journal) that provide an overview of the macro-economic environment.

While an MBA from Harvard can be very helpful, for the rest of society, the best place to start having success as a real estate investor is to remember the lessons from the local kid who is running the lemonade stand.

If you are someone who needs more than a tiny lemonade stand to motivate you about considering using this downturn as a buying opportunity for investment real estate, maybe these factoids are a form of motivation — 75% of all millionaires made their money investing in R/E. Since research shows that only 3% of all Americans are millionaires, your chance of being a millionaire is down to less than one in a hundred if don't invest in real estate.

In summary, while you may be more popular at school if you became skilled at playing video games inside, to get a healthy tan and money in your pocket, you need to create a lemonade stand. Whether or not you had your own lemonade stand as a child, as an adult, the best lemonade stand is to add investment real estate to your plan of long-term financial independence. Just like real estate, lemonade sells at the highest price when it is very hot, yet the prices drop when things are cool. If you are a seller, a hot market is ideal. If you are a buyer, then look for when sales are cool, do your research, and listen for Mr. Opportunity knocking in your neighborhood.

Leave a Comment